The 10 Best Investment Apps to Grow Your Wealth

Best Investment Apps – With the pressures of day to day life, it’s often difficult to find the time to sit down and plan your investments.

Well, not anymore!

Thanks to a wave of new investment apps, you can plan and manage your investment strategy on the commute to work, during your lunch break or from the comfort of your own home, using nothing more than your smartphone.

What’s even cooler, is some of these apps round things up for you and tell you what to invest in, making your decision process super easy.

So, if these types of investment apps sound like something you’d like to use, read through the list, download an app that appeals to you most, and take control of your financial future.

Here’s a list of the 10 best investment Apps:

The 10 Best Investment Apps

The list of investment apps and figures mentioned below have been compiled from various sources around the web, such as The Points Guy & The Balance.

These are the 10 best investment apps in 2020:

10. Fidelity

Fidelity’s investment app has received a lot of positive reviews in the app store, almost 900k with an average star rating of 4.7 out of 5.

It offers a range of features that allow you to easily, set up, track and manage your investments, all from the comfort of your smartphone, tablet or smartwatch.

For example, you can view your portfolio, manage your orders, history and transactions and set-up customizable alerts received via push notifications.

On top of that, the app is compatible with Touch ID & Face ID for easy and secure login.

If you’re a fan of the Apple Watch, you can view market reports, receive push notifications for investment opportunities and check domestic and international markets in real-time.

Also, something else to bear in mind when managing your finances is that if you get stuck with anything, or you just have a question, Fidelity offers fast and easy to locate support. You can call them from the app or contact them through various social media options.

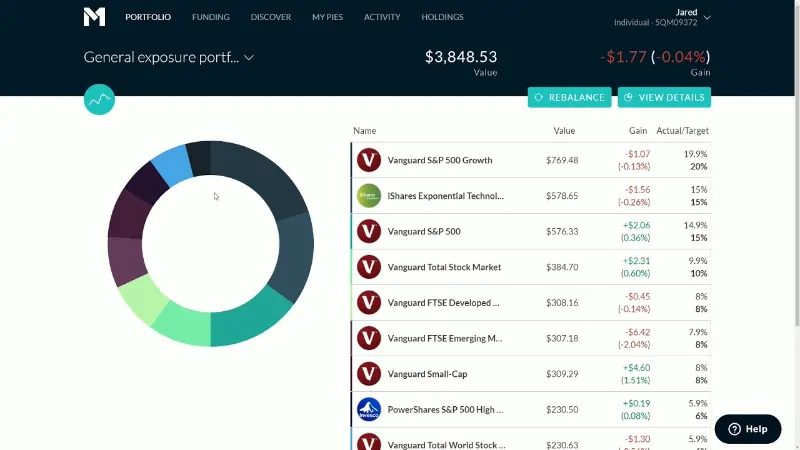

9. M1 Finance

The next investment app to make the cut is one from M1 Finance.

The overall UI and design of their app is really nice. In the app store, it’s been rated over eight thousand times and received an overall rating of 4.7 out of 5.

M1 Finance has an array of appealing features, including Automatic deposits, commission-free investing & super easy tax reporting.

You can also set up direct debits, pay bills and integrate your checking account within the app.

Once you’ve invested around $10,000, you’ll unlock a flexible low-cost portfolio line of credit.

They also offer a premium version, which includes features like, 1.5% APY* and 1% cashback and 0.25% discount on M1 Borrow, plus a second daily trading window.

The main drawback for using this app is that it does not feature tax-loss harvesting. If this is something you need, then you’ll be better of choosing one of the other investment apps from the list.

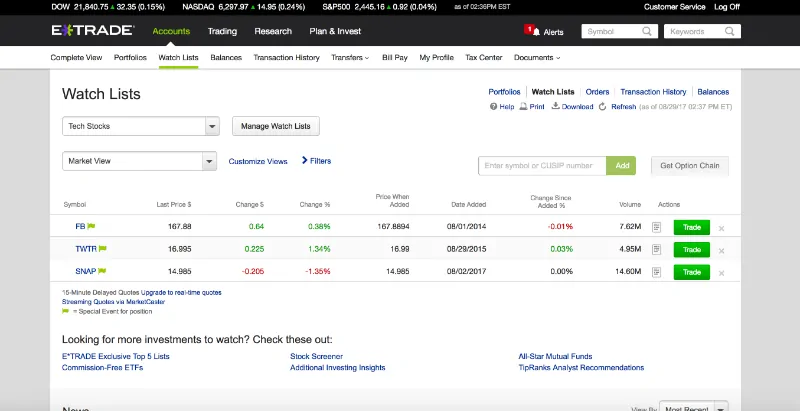

8. E-Trade

Coming in at number eight is E-Trade.

With over 91 thousand ratings on the app store and an overall rating of 4.7 out of 5, E-Trade is definitely a top contender in the investment app world.

If having access to lots of investment options is something you like, then E-Trade could be for you. You’ll have access to thousands of ETFs, stocks, futures, mutual funds, bonds and more, plus a large proportion of the mutual funds are completely commission-free.

As well as all the trading options available at your fingertips, you’ll also be able to set up personalized stock alerts and watch lists.

If you want to take more of an automated approach, you can opt for their “E-Trade Core Portfolio” option, and their robo team will provide you with relevant advice.

To get started, you’ll need a minimum balance of $5,000.

7. Mint

Technically not a complete investment app per se, Mint is still one of the most well known and recognized finance apps on the market right now.

Mint allows you to track your investments, but not actively invest using the app itself.

It’s more of a finance and budgeting app that lets you monitor all your investments in one place. However, we’ve included it on the list because it allows you to track your investments and we also think that they’ll include more investment features in the future.

It’s completely free to open an account and is the perfect app for managing and tracking your finances once you’ve got everything set up, i.e, your investments are already in place.

Mint is available for iPhone, iPad, Apple Watch, Android and most Windows mobile devices.

Overall, the UI, design and layout are great, so we’d recommend using it to monitor your finances once you’ve got all your investments set up.

It’s has a current rating of 4.7 out of 5 from almost half a million ratings on the app store.

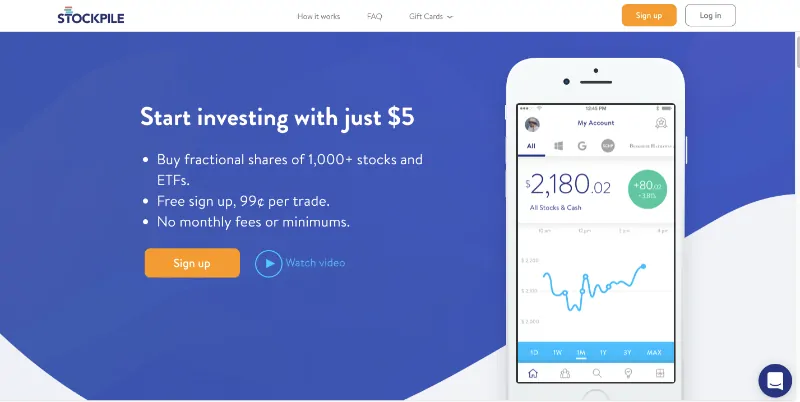

6. Stockpile

Stockpile lets you get started investing with as little as $5.

With over 30 thousand ratings on the app store and an average overall rating of 4.7 out of 5, this app seems to be making a lot of headway in the investment app market.

Using stockpile, you can buy and sell stocks just like any other investment app, but you can also buy fractional shares in over 1,000 brand name stocks and ETF’s, and gift single shares of stocks to whoever you wish.

The app is marketed toward families as well as individuals, meaning children of any age can begin learning how to invest, as long as their parents set up a custodial account. This is actually a really cool idea, as it makes investing a lot more fun and interesting for the younger generation.

Instead of kids sitting in front of the television, parents can teach them about money and incentivise them with a stock gift card to get them started.

Moreover, there are no monthly or annual fees using stockpile and you can make a trade for 99¢.

Stockpile uses 256-bit encryption to protect your data and protects your securities up to $500,000 dollars.

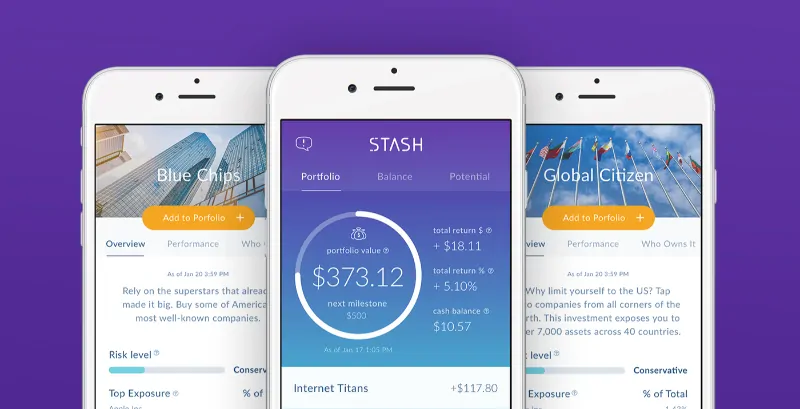

5. Stash

Marketed toward brand new investors, Stash is a great choice if you’re just getting started in the world of investing.

Like stockpile, you can start with as little as $5, and the app will help you choose investments and educate you as you go.

The app is filled with all sorts of trading and investment articles, tips and tricks, aimed at helping you understand how investing works. You can also participate in personalized challenges and track your progress.

After you download the app, you’ll be taken through a series of short questions to help identify your goals. From there, the app will provide you with a list of ETFs and stocks that are most suited to your needs. It’s then up to you to actively choose and manage those investments.

Similar to other investment apps on the list, you can buy also fractional shares, and Stash allows you to choose from over 110 individual stocks.

If you’re under the age of 25, you can open up a retirement account free of charge. Or, you can also open a Roth IRA for as little as $1 – $2 a month.

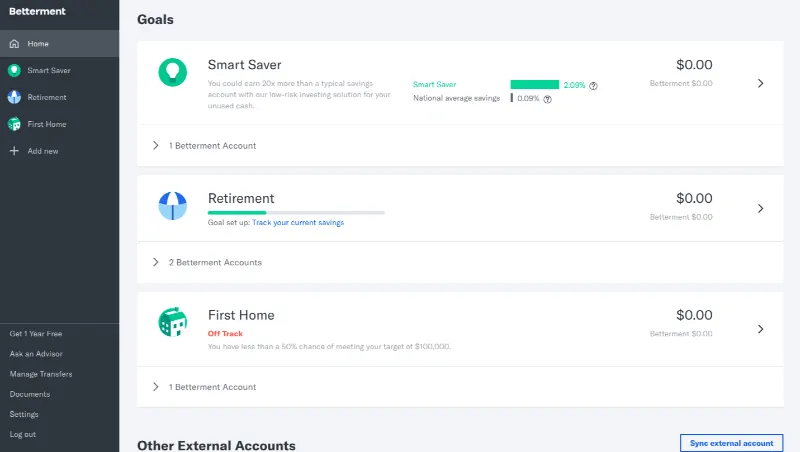

4. Betterment

The next investment app to make it on our list is Betterment.

Coined as one of the best apps for Tax-efficient investing, Betterment was the first publicly available investment app to use a robo-advisor.

After an initial survey, Betterment will create a custom portfolio for you and automatically conduct tax-loss harvesting on all accounts.

As an investor, you can also choose from a digital portfolio or a premium portfolio. If you choose the premium option, you’ll get access to certified financial planners and guidance on outside investment accounts.

However, if you want to use the premium portfolio option, you’ll need a minimum account balance of $100,000.

If you’re looking for the best investment app that doesn’t include fees, then Betterment isn’t for you, as their annual fees range from 0.25% – 0.40% of what’s in your account.

3. TD Ameritrade (Best Investment Apps)

If you’re a bit of an information junkie and like to know as much as you can before investing, then this app could be for you.

It’s jammed packed with educational data and stock research, as well as videos that teach you a variety of different investing strategies.

As you would expect from an investment app, you can view a breakdown of your portfolio, check up on your investments and make new trades.

And, like several others on the list, you can set up alerts to notify you of new investment opportunities or breaking news.

The TD Ameritrade mobile app is good for beginner and passive investors, as it offers a lot of advice and support.

The TD Ameritrade Trader App, on the other hand, is more suited for advanced and active investors as it contains more charts, technical information and analysis reports.

The app has received over twenty thousand ratings on the app store and has a current overall rating of 4.4 out of 5.

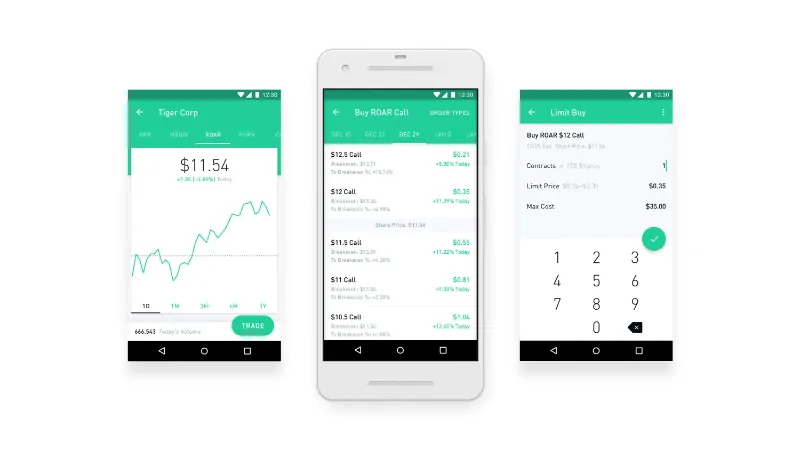

2. Robinhood (Best Investment Apps)

Are you looking for an investment app that’s completely free?

Well, this one’s probably your best bet.

Opening a normal account inside the Robinhood app is 100% free and doesn’t require a lot of information or effort to get started.

The core features of the app are focused on trading stocks from your watch list or that you already own.

You’re only able to access ETF’s, Stocks, options and cryptocurrencies, but are unable to use other investments like mutual funds.

Robinhood offers a premium “Gold” account, which is priced at $10 a month, which is how the app makes money. With this premium version, you get access to extended-hours trading and margin trading, as well a host of other features.

The app’s design was recognized by Apple in 2015 when they awarded Robinhood with a design award.

Currently, Robinhood is rated 4.8 out of 5 in the app store from almost eight hundred thousand ratings.

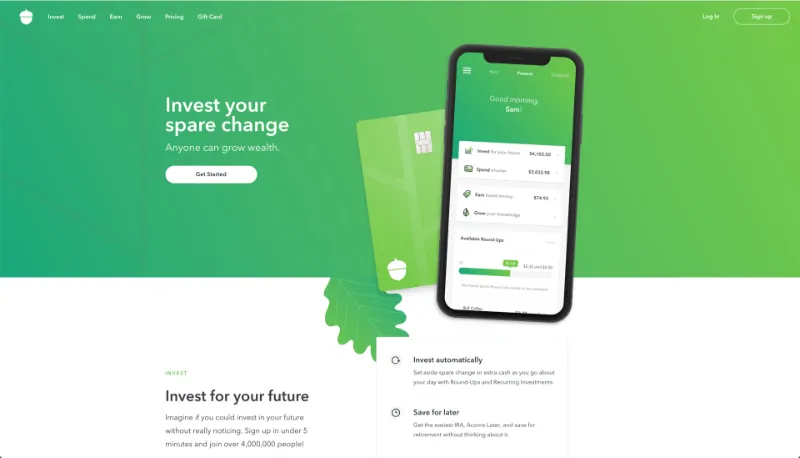

1. Acorns (Best Investment Apps)

Out of all the investment apps on the market, Acorns sits at the top of the tree as the best investment app in 2019.

If you’re totally new to the world of investing, and literally have no clue at all about what you’re doing, then download Acorns now as it offers a super simple solution to get you started.

After linking your bank accounts, Acorns will track your spending habits and “round up” all your purchases to the nearest dollar.

Then, it will transfer the difference to your Acorns investment account and start investing.

So, it makes it super simple to find the money to invest from your monthly budget and takes away all the excuses. You can also add more funds to your account whenever you like, manually, or set up one-time recurring payments. But, if you just let it do its thing, it will automate the investment process for you.

You can set up an account for free and Acorns does not require an account minimum.

Currently, Acorns has a rating of 4.7 out of 5 in the app store from almost 450,000 ratings.

Summary – The 10 Best Investment Apps

We hope you enjoyed our list of the 10 best investment apps in 2019.

Whether you’re just getting started, or looking for a simpler way to manage your investments, one of these investment apps should do the trick.

But, before you dive in, the bottom line is that you may need to spend some time understanding which option is the best for you.

Once you’ve got to grips with it, and feel comfortable with what these apps offer, you can more or less put your investments on autopilot!

Here’s a quick recap of the 10 best investment apps:

- Acorns

- Robinhood

- TD Ameritrade

- Betterment

- Stash

- Stockpile

- Mint

- E-Trade

- M1 Finance

- Fidelity

Also Read: The 10 Most Powerful Passports in the World (2022)

For latest showbiz updates / articles, visit Beskit Blog. Also visit our Jobs site for latest jobs in your area.

Disclaimer: All Images that are Used in this post from Instagram & Google Image and Credit Goes to their Respective Owner. Contact Us for Credit or Remove these Images.